The number of older Americans who call themselves boss is growing steadily. In 2015, the U.S. Bureau of Labor Statistics found the self-employment rate among workers age 65 years and older was higher –15.5% – than any other age group. Retired Americans are still working, and many are working for themselves.

Many who want to earn money in retirement turn to their hobbies as jumping-off points for launching a small business. Here are some ways to make money in retirement by turning your hobby into a successful business.

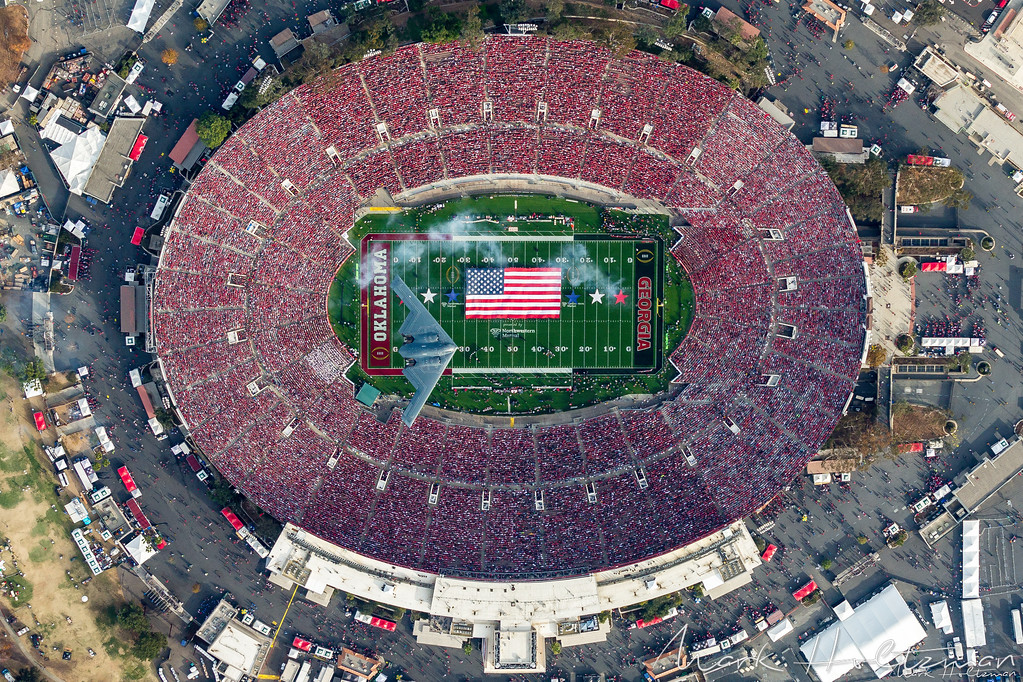

Mark Holtzman, retired sales manager turned aerial photographer.

What is a side business for seniors?

Retirees can face obstacles they may not have encountered as younger entrepreneurs, such as a tighter monthly budget, but they have an advantage when it comes to their hobby: They've already invested in equipment and training.

Here are a few other benefits of turning your hobby into a business.

Low upfront investment

If you have little investment capital, savings or a low credit score, securing funds to start a small business can be challenging. Choose a side gig with low upfront costs, and use the resources, materials and knowledge you already have.

Small-scale production

Consider starting a business that doesn't require a substantial investment into purchasing materials, equipment or storage space. If your business will be manufacturing products, you don't want your manufacturing capacity to exceed your ability to store unsold inventory. Start small and grow from there.

Work from home

If you chose early retirement to reduce the risk of becoming ill with the coronavirus, you may want to start a small business from the comfort of your home. An added benefit of starting a home-based company is that you have low overhead costs: no office space leases, extra utilities, parking costs, etc.

Flexibility

Launching an online retail website can be an inexpensive way to market your goods and services. It can also be a good business route to take if you prefer some flexibility with your schedule; for example, you don't have to abide by a rigid schedule (8 a.m. to 6 p.m.) as you would with a brick-and-mortar storefront.

Which hobby should I choose?

What is your most valuable hobby? It may even be something you wouldn't even think of as a hobby – a much broader pursuit than making pottery or writing poetry.

For example, maybe you enjoy researching your family history, looking at photographs and learning about lost relatives. You could turn that into a home-based genealogy business helping others uncover their family trees or writing the life story of an ancestor.

Maybe you love problem-solving and are obsessed with doing crossword puzzles or brainstorming ideas for new products. It may not be a "hobby" in the strictest sense, but problem-solving is a skill many people leverage to start profitable businesses.

Linda Nagamine worked as an airline customer service representative for 28 years; after retirement, she turned her problem-solving skills into a way to help people keep track of their keys. Nagamine developed the Joyful Keyper - a simple device for keeping keys secure but easily accessible inside a bag or purse.

After retiring, Linda Nagamine invented Joyful Keyper to help women find their keys faster in their purse.

"There was nothing in the marketplace that effectively solved my daily problem of searching for my misplaced keys," she explained. "It had to be something anyone could use and be reliable. I didn't want another electronic/tech device to complicate my life."

Now, Nagamine's Joyful Keypers are sold online and in women's boutiques.

Take a careful inventory of your hobbies. Don't overlook some if they don't fit the traditional definition of what a hobby is – think outside the hobby box. A hobby is anything you enjoy doing. Find that skill or talent and match it with something that's marketable, then you've got a great start for a small business.

Will my hobby make a successful business?

You may have to make some adjustments to your business idea to turn your hobby into a marketable product or service that people want. If you have multiple hobbies or interests, think about how you can combine all or some of them into a workable small business.

Teaching

During your life, you've worked hard to become knowledgeable and highly skilled with your hobby. Impart your knowledge to others. For example, if you are an excellent golfer, perhaps you could offer golf lessons to members in your community.

This advice applies to skills and talents other than sports (e.g., musical instruments, foreign language, knitting, cooking, painting, etc.). If you want to teach something that isn't necessarily hands-on, you could offer lessons online.

Woodworking

Many retirees enjoy hands-on activities like woodworking. While this can be a relaxing favorite pastime, it may potentially become a lucrative business. For example, suppose you're into woodworking, and you love to play chess; you could combine these two passions to start a business that produces customized chess boards and sell them online.

Outdoor activities

Many outdoor activities can become potential income streams. For example, maybe you love fly fishing in your spare time, and you also feel a deep need to give back to your community. You could establish a rehabilitation service for wounded veterans, which is what Ed Nicholson did with Project Healing Waters Fly Fishing.

A hobby like fly fishing could be a way to help others.

Writing

Another potential option, if you have a passion for writing, is to start a blog. Write entertaining blog posts about your life experience or your travels, provide younger moms with firsthand advice about raising children, share your homemade cooking recipes – whatever you are passionate about. Although starting a website is easier than ever, you want to learn how to monetize your blog.

If a blog doesn't appeal to you, consider writing a book. Recording your life experience and sharing it with the world can be a great way to earn some extra cash while remaining socially distanced.

Photography

Earning a steady income as a photographer can be tough, but if you can put a unique twist on what you are photographing and how you are taking those images, you may be able to turn it into a business.

Mark Holtzman turned his love of aviation and photography into a successful aerial photography business. Holtzman began pursuing photography as a hobby when he was working as a sales manager for an auto dealership, flying on weekends and shooting with his film camera. Eventually, Holtzman's side hustle became his full-time business and led to an award-winning photo he took that was displayed in several publications, including Vanity Fair and The Wall Street Journal.

Mark Holtzman's photo of a flyover at the 2018 Rose Bowl appeared in ESPN.

Holtzman also did something every aspiring, retired entrepreneur should consider: He recruited help from his kids. Holtzman's son Steven joined when the side business became a full-time gig, helping his dad with various computer and technical issues.

"When we talk about if he'll ever retire, he gives me this look that says, 'I'm already pretty much retired,'" Steven Holtzman said. "He loves what he does, since he gets to fly around and take pictures, and doesn't see himself ever really retiring."

Do I want a full-time or part-time gig?

While you want to transform your hobby into a business, that doesn't mean you want to give up the freedom and relaxation that retirement offers. Hobbies are what we do for free, and we do them when we want to. With a hobby-turned-business, you have to contend with deadlines, customers, shipping, emails, payments and the like. No one wants their hobby turned into "the thing I used to love doing."

A business requires considerable mental, emotional and physical effort. To ensure your new venture doesn't turn into an all-consuming business, consider the things that make up your current retirement life. Questions like these will help you decide whether you want to go full or part-time:

- How much time do I want/have to invest?

- How much extra revenue do I need?

- How will work impact my time with family and friends?

- Do I have enough startup capital to go full time?

- Do I have other commitments (e.g., volunteer work) that will suffer?

- How much stress can I afford to add to my life?

How to finance your post-retirement business

Whether you plan to use your savings or take on debt, you'll probably need some upfront capital to invest – even if it's just to print fliers for your next quilt show. If need funding options for your new retiree business venture, here are a few to consider.

Bootstrapping

If you're advanced in your hobby, you already have plenty of equipment and knowledge. Startup costs may be low enough for you to finance your new business through bootstrapping – using your own capital and any operating revenues to start and grow your business. Bootstrapping keeps you debt-free. However, self-funding also means you may lack the necessary upfront revenue for hiring or advertising, two essential components to business expansion.

Bootstrapping is good for retirees because it helps minimize risk. Older entrepreneurs don't have decades to correct their finances from a business that's gone bust. Start small, and test the market to see if your business is viable before taking on debt or dipping into your nest egg.

Personal loans

If getting your new business off the ground means a small purchase – materials, equipment, ads – then a personal business loan might be right for you. Borrowers with good or excellent credit scores (690 or higher) enjoy the widest repayment options and low interest rates. Generally, personal loans have lower APRs than credit cards, especially for high credit score borrowers.

Government funding

The federal government helps seniors start or expand their new businesses by providing loans that are guaranteed by the U.S. Small Business Administration. Because the SBA guarantees loans (much like the Federal Deposit Insurance Corporation) for lenders, they make it easier for seniors to access capital from private lending institutions. The SBA's online referral tool makes it easy for small businesses to connect with participating lenders.

Venture capital

If you'd rather avoid lending institutions and find a venture capitalist, the SBA can help with that too. The agency can connect senior entrepreneurs with Small Business Investment Companies (SBIC) - a privately owned company licensed and regulated by the SBA. SBICs offer loans or purchase equity in companies.

Crowdfunding

Sometimes the best way to start a new business is to turn to the general public for financial support. Crowdfunding sites like Kickstarter, Indiegogo and GoFundMe let you do just that. By creating an online fundraising campaign to start your business, you're able to solicit funds from online donors. Instead of paying them back, you reward them with gifts, like the first version of your product, or a signed copy.

Retirement accounts

While probably a last resort, drawing funds from your retirement account is a workable funding option that offers more investment control compared to lending institutions. If you have a 401(k), the government allows you to borrow against, invest or withdraw from your retirement account, but there are plenty of hoops to jump through. Consult a retirement account professional before withdrawing funds from your retirement account.

Rollovers as Business Startups (ROBS) let you roll over your retirement savings into a new 401(k) and invest it into your own company. It's a complex process, and while you avoid taking on debt and penalties, it puts your retirement savings at risk.

How will my side business affect my taxes?

Your small business will definitely impact your taxes. Hopefully, you'll see a profit, and you'll need to report it on your yearly income taxes. That's a good problem to have.

However, your tax preparation will become more complicated as well as you save receipts to deduct business expenses and record your overhead costs. Here are some ways starting a business will affect your taxes.

Social Security benefits

After you turn a profit from your new business, you may have to start claiming a percentage of your Social Security benefits as taxable income, especially if Social Security benefits were your only source of income prior. The standard percentage is 85%, but the percentage will depend on the amount of your combined income. You can use the Notice 703 IRS form to calculate how much of your Social Security benefits may be taxable.

Business expense deductions

Like any other for-profit business owner, you can reduce your tax burden by claiming business expenses on your tax returns. The IRS requires a business expense to be "ordinary and necessary" to the operation of your business.

Two of the most common business expenses for small business owners are the business use of your home and business use of your car. You're able to deduct a percentage of your costs for each of these, whether it's deducting the cost of a home office or standard mileage rates for travel. You can even deduct part of you business startup costs.

Business expense deductions definitely complicate your yearly tax filing, but millions of seniors manage it. You'll need to keep receipts for your expenses and track your car mileage, but the tax savings are worth the time.

Your tax rate

Your new business profits will increase your taxable income and thus your tax rate. This may put you in a new tax bracket, depending on your income level. Because your extra income can affect what percentage of your Social Security is taxable, it's smart to calculate your retirement tax rate ;to find out how much your business profit will impact your taxable income. Fine-tune your tax rate estimate by first determining your standard deduction for retirees.

Self-employment taxes

When you worked for an employer, they withheld your FICA, federal, state and other payroll taxes. As a self-employed business owner, it's now your responsibility to track and report incoming funds. Generally, individual business owners must pay self-employment tax (Social Security and Medicare taxes), as well as income tax. You have to file an income tax return if your net earnings from self-employment were $400 or more.

Quarterly reporting

Business owners who expect to owe more than $1,000 in taxes for the current tax year – after subtracting their withholding and refundable credits – have to make quarterly self-employment payments to the IRS. Instead of a Form 1040, you'll use a Form 1040-ES ;to estimate and file your quarterly self-employment taxes. You can pay your quarterly self-employment taxes on the IRS' website

Because of limited savings, small businesses can find it difficult to pay their quarterly taxes. Make sure you accurately estimate and withhold them throughout the year, so you're not surprised with a big tax bill.

Resources for starting a small business

Here are some additional resources to help you learn how to make money in retirement.

Entrepreneur training

- S. Small Business Administration:The SBA offers free online courses to help you start and run your small business.

- Chamber of Commerce Foundation Blog: Find a variety of articles on entrepreneurship.

- Khan Academy:Watch several interviews with famous entrepreneurs about their strategies.

- Kutztown Small Business Development Center: The Kutztown University SBDC offers free online learning programs that cover a variety of topics, including business planning and marketing.

Networking

Professional advice on how to start your small business helps you avoid common small business mistakes early on. Here are some resources to connect you with the right people.

- SCORE: This is a nonprofit entrepreneur network that connects seniors with expert business mentors.

- Small Business Development Centers (SBDCs): SBDCS provide free, extensive, one-on-one professional business advice. Find an ;SBDC near you.

- Meetup groups: Meetups are a great way to find other small business owners, freelancers or individuals who share the same hobbies as you.

- Global Institute for Experience Entrepreneurship (GIEE): GIEE, a nonprofit, helps adults age 50 and over build their businesses.

Other resources

- Veteran Entrepreneur Resource Guide:This resource connects military veteran entrepreneurs with small business resources.

- "Developing a Business Plan":This free online guide explains how to create an effective business plan.

- "27 Online Business Ideas for Beginners":This blog article outlines a variety of online business ideas.

Skye Schooley contributed to the writing and reporting in this article. Some source interviews were conducted for a previous version of this article.