Do you have a viable concept that you want to transform into a successful business?

Or are you managing a bootstrap startup that desperately needs a cash injection?

While many small business owners have relied on sheer grit and determination (as well as the occasional handout from family, friends, or even crowdsourcing) if your potentially prosperous company has hit a financial roadblock, then you’ll need to start thinking about attracting investors.

Considering the depressing statistic that nine out of 10 startups fail, you might be wondering what makes people even want to start a startup or to invest in an unknown entity in the first place. Well, here’s why:

Because that lowly 10 percent might just become the next Twitter, Facebook or Instagram.

Behind every successful startup is a risk-taking investor who dared to jump on board at an early stage when the stakes were higher, willing to take a gamble with the hopes of funding the next Zuckerberg.

An explosive growth in technology startups has inspired a sizable boom in venture capital investing. As long as there’s a viable opportunity around, there will always be a venture capitalist or angel investor ready to get on board, with the only caveat that your company needs to be demonstrably special to stand out.

Investors Are Getting More Demanding

With so few barriers to entry, it’s never been easier to found a new company, but with more and more startups competing for funding, it’s not surprising that investors are stepping up their expectations. According to Tom Villante, angel investor, founder, and CEO of FinTech payments company, YapStone, in 2016 the capital markets for emerging startups may be running into some headwinds.

There is still some funding available, but the competition for it is increasingly fierce. Let’s go back to the statistics for a minute; with some 60 percent of startups surviving just three years before they’re acquired, flounder, or go out of business, the bar is significantly raised for entrepreneurs looking to attract investors.

Venture Capitalists

Before figuring out how to attract an investor, you’ll need to decide on the type of investor you want to attract. Venture capitalists are a form of private sector finance dedicated to helping new companies establish themselves and grow. They typically seek out opportunities in growing markets, such as technology, FinTech, IT and Biotech.

Venture capitalists are far more likely to invest in an unknown entity than a bank because the payout could potentially and enormously outweigh the risk. VCs will, therefore, provide all the cash that your company needs, but often at a high price, which usually involves a profitable exit strategy, or demanding enough shares in your company to influence decision making.

Angel Investors

Angel investors are individuals who personally invest in startup companies to help them grow. The concept originally began in the 1920s in Los Angeles, when wealthy individuals began to finance movies and became dubbed as “angel investors”. As the substantial rewards and payouts became apparent, angels soon spread their wings to other fields and become known as business angels.

It’s hard to gauge the exact size of the of the U.S. angel investment market, as many investments are made on an individual basis and therefore not subject to disclosure rules, but it is estimated that angel investors have long surpassed venture capital investments, and they continue to grow as a viable startup financing option.

A survey by the Center for Venture Research at UNH indicates that the total U.S. angel market grew from $17.6B in 2009 to $24.1B in 2014 alone and has doubled in Europe over the last five years. But the involvement of angels plays a pivotal role in entrepreneurial success in more ways than merely financial.

Insider Knowledge

Angel investors come from a variety of backgrounds and may invest in startups for personal reasons, or because they’re passionate about a particular sector. Startups can gain a lot more than a simple cash injection from the right angel investor, including industry expertise, inside knowledge of customers and competitors, personal network contacts and potential partnerships.

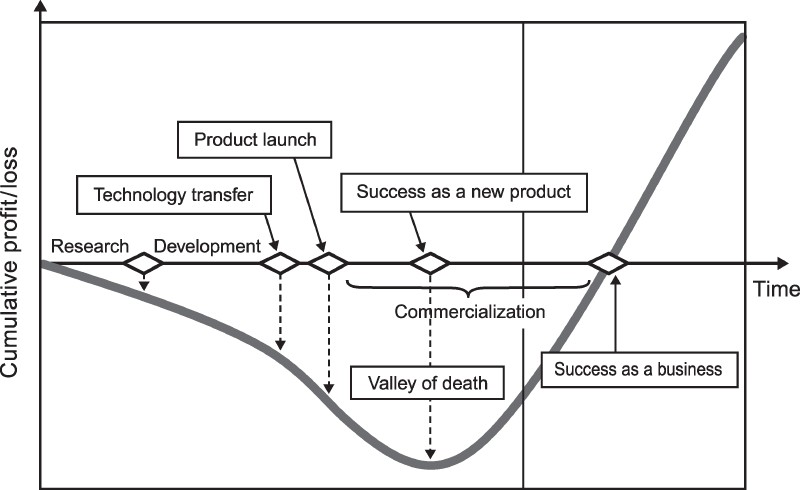

Particularly useful for green and inexperienced management teams, by serving as mentors, angels can be lifesavers in helping your startup pass through the “Valley of Death” period when success or failure literally hangs in the balance and covering the negative cash flow in the early stages can lead to the end of the business.

Many startups will turn to an angel investor first before going to a VC firm, as often one individual angel will only contribute sufficient funds to carry the startup through its first year, typically investing somewhere between $500,000 to $1 million. But whether your business wants to solicit the help of an angel investor or a venture capitalist, here are a few key pointers to keep in mind that just might help you stand out in the sea of startup competition and attract investment for your business:

Passion

While it might sound a little cliché, a little passion goes a long way and it’s very rare to come across an entrepreneur without passion. In fact, I’d go as far as to say that an entrepreneur without passion is like a runway model without clothes. Not entirely impossible, but extremely unlikely. And any smart investor will steer away from any "Emperor’s new clothes" type of startup. Angel investor, Villante, affirms:

“Inspiring people who exude passion and positivity send a deeper message to investors”. So remember to be passionate above all and let it shine through in your proposal. If you don’t love what you do and remain enthusiastic about it at all times, it’s hard to transmit that feeling to potential investors.

And if you can make an angel feel that you have a special quality they’re looking for and will do anything it takes to succeed, then your chances of attracting investment are much higher. In fact, entrepreneurial passion directly affects how much capital is a startup receives.

Commitment

If you’re going to go out on a limb and prove to investors that your passion is your business, then you’re going to have to commit wholeheartedly to your project. According to Villante, the days of moonlighting as an app developer while working a full-time job just don’t cut it anymore. Competition is cut-throat and if you can’t give your all to one certain project, then it’s unlikely that you will see it through to its full potential. If you really, truly believe in your product or service, you’ll find a way to work on it full time.

Being All In

Being “all in” is incredibly telling to any investor. If you’re able to convey your enthusiasm and drive to them, the chances are, they will sit up and listen. When Villante was angel investing in the late 90s, he found himself with five companies on his hands; none of which was particularly excelling over the rest.

YapStone, the online payment portal, showed the greatest potential, so Villante decided it was time to go all-in and become CEO, withdrawing his interests from the other companies. Today YapStone’s payment volume is more than $14 billion.

The fact that you have chosen to be an entrepreneur says that you have passion. So before you condemn yourself to a life of lament over the brilliant entrepreneur you should have been; why not get started right now? It’s time to put your money (or rather, someone else’s money) where your mouth is.

Traction

As part of the tightening requirements for startup finance, investors now want to see that a concept is gaining “traction” before they part with their funds. What that basically means is that you can prove there’s a sizable market for your product or service and that the wheels are set in motion for its success. Of course, gaining traction also creates a sort of “chicken and egg” situation for startups, as in order to build traction, you’ll need capital.

You may be lucky enough to attract an early angel for your cause, or have generous friends or a large credit card balance, but whatever you can do to help your company prove its value is going to help. Learn to cultivate its value and be innovative to attract investment early on. You don’t need to go overboard on marketing either as, if you’ve got a successful concept, product, or service on your hands, then it should speak for itself.

Think about successful startups like Facebook, Uber, and PayPal, who have never spent a lot of money on advertising, but instead focused on resources to build value into their products.

Strong Management Team

Venture capitalists above all look for a strong and balanced management team, flexible and skilled enough to face the challenges that may come their way. Your business plan, although a key asset, is not as important as your people. Investors rarely invest in ideas alone, as it’s much safer to invest in a great management team and passion.

Most successful companies are founded on great teams; a visionary, passionate leader with a global perspective, a talented technician with the skills to turn that vision into a reality, and a sales person to tailor the product to meet market demands. If your startup is missing a key position, then it will be far less attractive to investors.

Snappy Pitch

Finally, once you’ve secured your meeting with your angel or VC, remember that the days of lengthy presentations are long behind us. VCs are busy people, so have all your materials ready before you meet and create a snappy pitch that’s to the point and has clear goals. Use bullets to help key points and pertinent facts stand out and to address big issues in a few words. Make sure you highlight the talent of your team, state of development and future goals in a concise executive summary that cover these key topics.

Be sure to master a few different versions of your pitch tailored to the appropriate audience. Your micro pitch should be 30 seconds at networking events and around 20 minutes for potential investors. Avoid using vague terms or buzzwords and make sure you’re open to questions.

This is your chance to really sell yourself, your beliefs, your passion and your company to investors. Hone your storytelling skills and get them inspired. And remember, it’s only natural that potential investors will have a lot of questions before parting with their cash. So be open to answering them, as securing funding could be crucial to bringing your startup dream to life.