- Adjust your payment process to be client-centric. Offer a variety of tools and payment options to accommodate customer needs.

- Ensure cross-functionality for your payment processes. More and more buyers are now shopping from their mobile devices.

- Make payment processing easy for clients by using a simple interface and features like guest checkout.

Attracting people to your business is a big challenge, but it's only part of the feat when it comes to converting prospects into paying (and, ideally, repeat) clients.

Though it might not be the first thing on your mind when it comes to selling, the payment process is vital to the well-being of your business. Depending on the type of business you run, getting paid can look a little different, and some methods of payment processing are more user-friendly than others.

Here are a few simple ways to make the payment process easier for your customers.

1. Offer variety.

You may give customers a host of payment tools at checkout, but are they in sync with their existing payment behavior? As the experts at Column Five Media report, 56% of online shoppers expect to see a variety of payment options.

A customer-friendly checkout process should include the ability to pay with a multitude of tools, which may include major credit and debit cards, gift cards, credit card rewards or loyalty points, electronic checks, virtual currency, and mobile payments or wallets. Over time, you'll gain a sense for the types of tools your customers use the most often, but until you do, payment variety is key to closing the sale.

2. Adapt your processes to your ideal customer.

If you've ever stepped into an establishment that accepts cash only or mandates a minimum purchase in order to use a credit card, you've experienced payment processes that benefit the business rather than its customers.

The ideal payment processes are rooted in the preferences of your customer – not those of your staff, or even your ideal business model.

In some cases, the process your customer prefers isn't necessarily intuitive. For example, though self-service payment kiosks that allow the customer to control their checkout experience may seem like a customer-facing benefit, a Comscore study of shopper preferences revealed that the majority of European customers prefer checking out with a sales associate, even when they have the option to buy online or pay at a self-serve terminal.

3. Understand how the details of the sale influence their expectations.

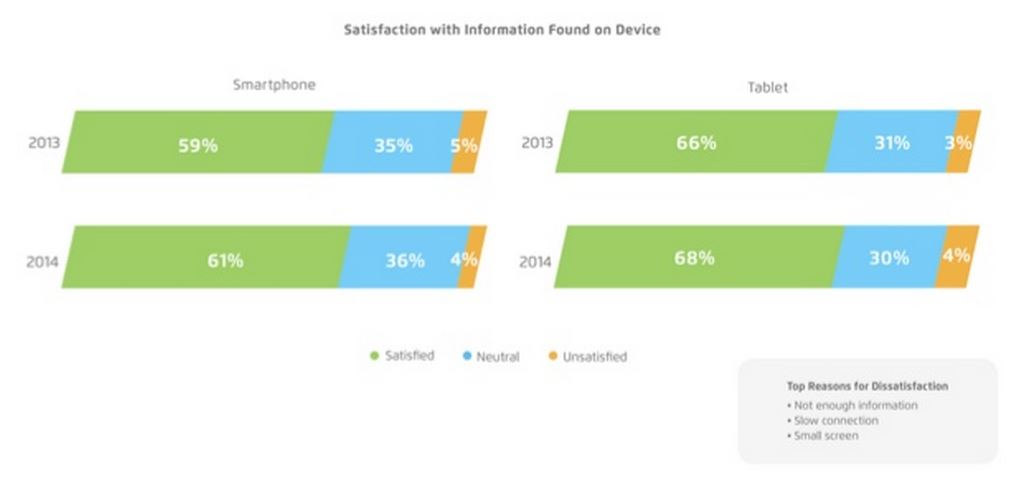

Making your payment processes easier for customers to use begins with knowing how they buy, including the type of device they use, the place(s) they tend to be when they purchase, and the payment tools with which they're familiar.

Customers who pay using mobile devices, for example, will have a different payment experience – in terms of screen size, device functionality, and the ease with which they can input payment information – than a person who is at a physical point of sale or buying online from a desktop computer. To ease payment for these many different types of customers, you must know who they are and give them the experience that meets their needs.

What you sell influences the customer's perception of ease of use in payment too. As experts at Search Engine Watch report, 29% of respondents to an xAd/Telmetrics survey who said their smartphone is a "critical tool" in their shopping experience prioritized their ability to apply coupons or special deals during checkout more when they were purchasing from a restaurant than they did when making an entertainment-related or technology purchase.

Ease of use also depends on where the customer is during checkout. (Are they in transit while making the purchase? Do they have access to a credit card? How much time do they have to complete the purchase?) Features like the ability to check out as a guest, log in using social media credentials, and potentially access previous card information stored in a virtual or mobile wallet can improve the payment experience for hurried customers.

4. Use simple design.

Busy interfaces can be a major turnoff to clients. The design for the payment processing software should be easy to follow. If the shopper has to go through multiple steps to check out, then the sale could be lost. Design for the checkout screen should follow the same principle. This helps confirm the safety of the transaction to the customer.

5. Offer guest checkout.

Registering an account can be a marketing tactic, but it may end up costing you a sale. Allow guest checkout to speed up the process. Some buyers prefer not to receive marketing emails and tend to respond positively when they're not required to create an account.

6. Simplify navigation to its barest form.

Test your payment process for the simplest experience, removing any distraction that could lead your customer to give up. Ensure that the payment process looks and feels like the rest of your brand – even if you use a third-party payment processor that takes the customer to a different site for secure processing.

Use prefill functionality (like filling in the customer's city and state based on the ZIP code) and clear language about what data is required, and eliminate any fields that are not mandatory. As the experts at Blue Acorn share, one client was losing 87,000 potential customers, simply because of clunky navigation during the payment process.

Today's customers are looking for nearly instant everything – from site load times and delivery options to simple checkout and payment systems. Ensuring an easy-to-use payment experience starts with putting your customer top of mind, and acclimating your systems to the way they prefer to browse and pay.