The numerous tax advantages of owning a partnership don't come without a good deal of paperwork requirements. For every dollar you might save by paying personal income rates instead of corporate taxes on your earnings, there's another confusing aspect of bureaucracy involved. Forms for declaring your partnership an S corporation or C corporation, partnership agreements and bylaws all become facts of life. On the tax side, there are Schedule K-1 forms.

Partnerships must use Schedule K-1 tax forms to distinguish the business's income from their owners' personal income. By doing so, your partnership is more likely to avoid the $54,171 in tax penalties the average partnership faces each year for improperly filing their taxes. Completing a Schedule K-1 form may seem difficult at first, but with the below primer, it doesn't have to be.

What is a Schedule K-1 tax form?

A Schedule K-1 tax form is found within IRS Form 1065 – it is the form you'll use to report your partnership's net income for the tax year in question. Partners in a partnership or LLC will each receive a Schedule K-1 from the partnership.

Who has to file a K-1 tax form?

All partnerships must file K-1 tax forms for each partner as part of their tax returns. Additionally, the partners must include a K-1 tax form with their individual tax return whether they are a partner in a general partnership, limited partnership, limited liability partnership or an LLC taxed as a partnership. You must also file a Schedule K-1 if you're a shareholder in an S corporation.

Partners must file Schedule K-1 forms because partnerships are taxed as pass-through entities. In this structure, a company's profits and losses "pass through" the partnership to all of the partners without being taxed. Schedule K-1 quantifies this profit or loss, and perhaps more importantly, it clarifies how much of your partnership's loss or income you should include in your personal tax returns.

K-1 forms for business partnerships

Since the co-owners of a business partnership, rather than the business itself, pay taxes on the company's income, the partnership must file several Schedule K-1 forms. This way, each partner's share of taxable profits or losses is properly recorded for both the company and the individual owners.

Additionally, each partner must receive a copy of their Schedule K-1 for use in their personal tax returns. Although this arrangement may feel tedious or confusing, filing and distributing K-1s is easy, and some examples should clarify this.

Let's say you're a partner in a company that earns $50,000 of taxable income in a given year. If you and your one business partner each own 50% of the business, you should each receive a Schedule K-1 that declares $25,000 of income. For four equal partners, this amount drops to $12,500. For one partner who owns 40% and another who owns 60%, the former will receive a K-1 for $20,000 and the latter for $30,000.

K-1 forms for LLCs

By default, your LLC is a partnership, but you can file IRS paperwork to register it as another type of federal business structure. Whether you will have to complete a Schedule K-1 form for your LLC taxation depends on this structure. If your company is a C corporation or sole proprietorship, it does not need to file a Schedule K-1. Otherwise, K-1 forms are required.

If your company is a partnership, you'll file a K-1 as described above. The process works somewhat differently for S corporations. Within your company's annual Form 1120-S tax return, you should include K-1 forms for each shareholder. Each K-1 should state the shareholder's profits, losses, credits and deductions. Each shareholder should also receive a copy of their K-1 for use with their personal tax returns.

K-1 forms for trust and estate beneficiaries

Occasionally, a living trust is a partner in a partnership. In this case, you should be aware of how K-1 forms work for trusts or estates.

If a trust or estate passes its tax burden to its beneficiaries, the trust or estate must include a Schedule K-1 in its IRS Form 1041 tax return and send a copy to the beneficiary. The beneficiary will then include this K-1 form with their individual tax returns. This K-1 will likely include more money recorded as distributions than ordinary income.

Where can you find a Schedule K-1 tax form?

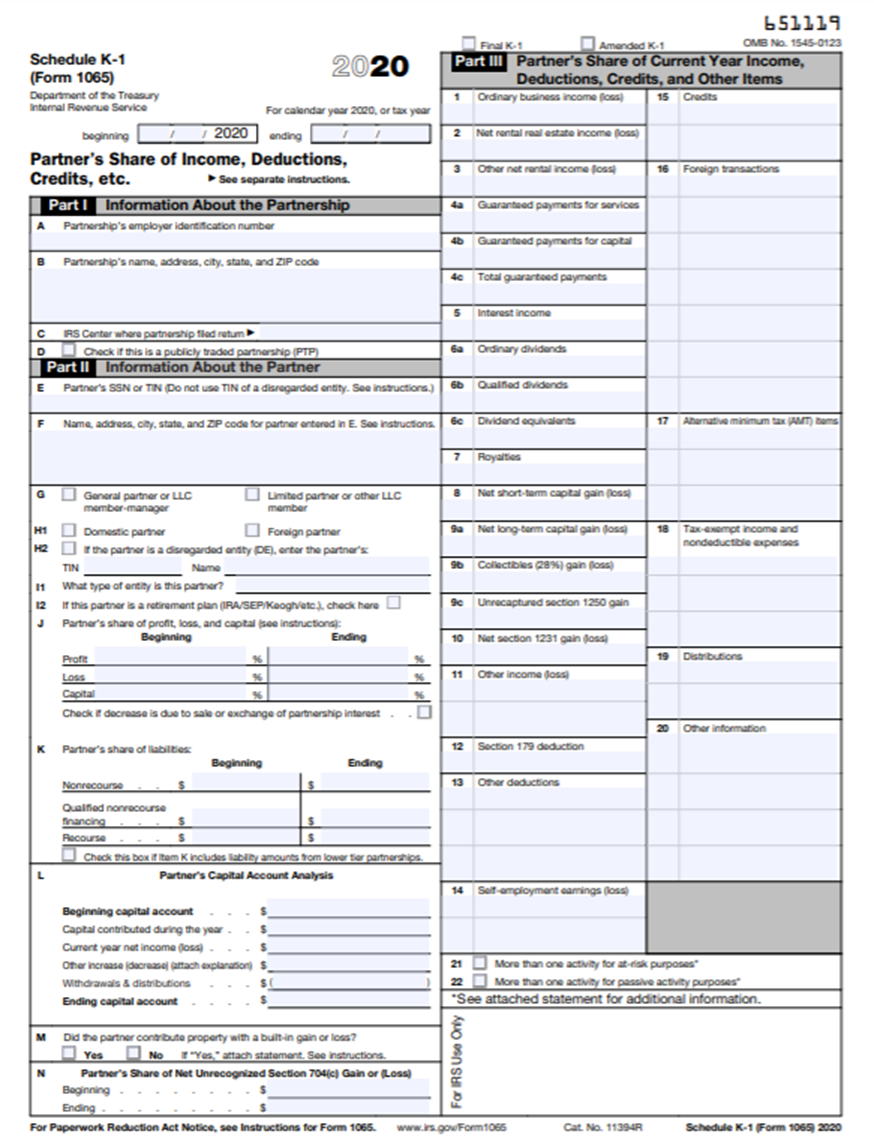

The IRS has Schedule K-1 forms on its website. You can download the K-1 form in fillable PDF format for either you or your accountant to use. You'll know you have the right form if it looks like this:

How to fill out a K-1 form

To complete a K-1 form, take the following steps:

1. Indicate the tax year in question.

You should see boxes for adding the start and end dates of the tax year in the top left corner of your K-1 form. Fill these out before proceeding further.

2. Add your basic identifying information.

In Part I of the K-1 form, you should see spaces for adding your company's employer identification number, name and address. Add this info here.

3. Indicate the IRS center where you filed your tax return.

You'll need to add this information in Part I, Box C. To find this info, look at your previous tax return or ask your accountant.

4. Add the partner's identifying information.

Each K-1 form that your partnership completes is for one partner. To make sure you don't file the wrong information for the wrong partner, add the appropriate partner's identifying number (likely a Social Security number), name and address at the top of Part II.

5. Indicate the type of partner.

Use Part II, Box G to indicate whether the partner is a general or limited partner. In Box H, check domestic or foreign partner as appropriate. Then, in box I1, write "individual" to indicate that the partner is a person, not an entity.

6. List the partner's profit, loss and capital shares.

If the partner in question owns 50% of your business, indicate this percentage in all six fields in Part II, Box J. The numbers in the "Ending" column will only differ if the partner's share of the ownership changed at some point during the tax year.

7. Complete the liability share and capital account fields.

Assuming your partnership uses accrual-based accounting, you'll need to complete Part II, Boxes K and L to reflect the partner's share of the values listed therein. This part can get tricky, but an accountant can walk you through it based on your books.

8. Indicate any property contributions with built-in gain or loss.

Occasionally, assets that a partner contributes to a company come with built-in gains or losses. Check the appropriate item in Part I, Box M to indicate any such gains or losses.

9. Add the partner's ordinary business income.

In Part III, Box 1, you must add the partner's direct income from the business. If the partnership generated $75,000 in income during the tax year and the partner owns 50% of the business, their income for Box 1 would be $75,000 x 0.5 = $37,500.

10. Add additional income line items.

Often, you will also need to add dollar amounts for the following line items in Part III:

- Guaranteed payments (Boxes 4a, 4b and 4c)

- Interest income (Box 5)

- Section 179 equipment deductions (Box 12)

- Other deductions (Box 13)

- Self-employment earnings (Box 14)

- Distributions (Box 19)

Your accountant may find most of these numbers more readily than you can, but calculating your self-employment earnings is usually simple. In general, it's the same as your ordinary business income, since the IRS levies self-employment taxes on companies with pass-through taxation structures.

11. File your K-1 form and give all partners copies.

Once you've followed the above steps, your K-1 form is ready. Add it to your IRS Form 1065, and send each partner their copy. Instructions for individual use are available on page two of the K-1 form.

Despite the above guidance, you're likely to still have questions, as Part III of the K-1 form has over a dozen fields where you can enter profits or losses. If you have questions, ask your accountant or bookkeeper. If you don't yet have one, decide whether an accountant or bookkeeper is better for you, then hire one. With a financial expert in your corner, keeping your partnership tax compliant should be far less of a hassle.