When welcoming a new hire to the team, small business owners must do a lot more than train them on their positions. One big task is making sure new employees get paid properly and that all the necessary payroll forms are filled out correctly.

While owning a business can be rewarding on many levels, managing payroll forms might be a pain if you're not familiar with the ones you need. There are many forms to consider depending on your employees and business type, and it's important to get them right.

The Internal Revenue Service penalizes businesses for filing incorrectly or failing to pay employment taxes. Fines vary by charge level, with federal offenses typically more expensive than state ones. In previous years, the IRS implemented nearly 7 million payroll tax penalties, which amounted to $4.5 billion. This is a sign of how seriously the IRS takes these penalties and why it's important to understand each form and when it's due.

Editor's note: Looking for the right payroll service for your business? Fill out the below questionnaire to have our vendor partners contact you about your needs.

What payroll tax forms do you need to know about?

Missing a payroll tax deadline or filing the wrong form can have expensive consequences. Below we'll explain the payroll report forms that you need to keep on your radar.

| Form name | Due date |

| Form 941 | April 30, July 31, Oct. 31, Jan. 31 |

| Form 944 | Jan. 31 |

| Form 940 | Jan. 31 |

| Form W-2 | Jan. 31 |

| Form W-3 | Jan. 31 |

| Form 1095-B | Jan. 31 |

| Form 1094-B | Feb. 28 |

| Form I-9 | 3 days after the hire date |

| Form W-9 | At the time contract work is ordered |

| Form 1099-MISC | March 1 if filed by paper, March 31 electronically |

| Form 1099-NEC | Jan. 31 (to recipient and IRS) |

| Form W-4 | Feb. 15 |

| Form 8027 | March 1 if filed by paper, March 31 electronically |

Payroll report forms

A payroll report form informs the government of your employment tax liabilities. On this form, document the taxes you withheld from employee wages and the payroll taxes you paid. Be sure to submit payroll reports for both federal and state taxes.

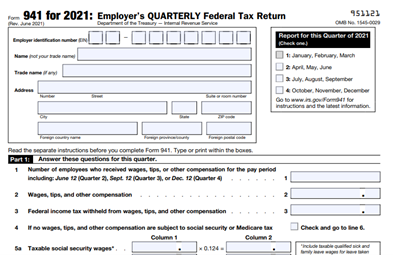

1. Form 941

Form 941, the Employer's Quarterly Federal Tax Return, reports the number of employees you have, their wages and taxable tips, and the federal income taxes you withheld. Social Security, Medicare taxes and sick pay are also documented here, along with any adjustments made to them. You must file this payroll tax form unless you have already submitted a final return, are a seasonal employer, or employ farm or household workers. A payroll form should be filed quarterly.

Due dates: April 30, July 31, Oct. 31, Jan. 31

2. Form 944

Very small businesses sometimes use Form 944 instead of Form 941. This form is the Employer Annual Tax Return, and the only businesses that qualify to use it are those with $1,000 or less in annual liabilities for Social Security, Medicare and federal income taxes. Additionally, you must have a written notification from the IRS permitting you to use this form instead of Form 941. This payroll tax form is submitted annually instead of quarterly, so if you're qualified to use it, you should.

Due date: Jan. 31

3. Form 940

Form 940 is the Employer's Annual Federal Unemployment Tax Return. This payroll tax form is used to report the federal unemployment tax, or the FUTA tax, in reference to the Federal Unemployment Tax Act. This tax funds unemployment compensation to employees who have recently lost their jobs. Your business must pay FUTA taxes if you paid at least $1,500 in wages in a quarter within the past two years. These taxes are paid quarterly but reported once per year.

Due date: Jan. 31

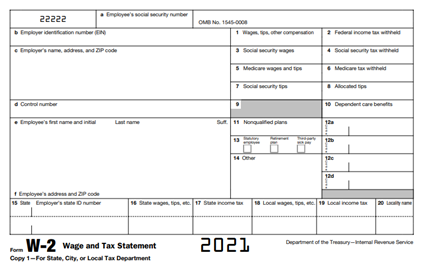

4. Form W-2

The W-2 is one of the better-known forms and should be given to each employee at the end of each year. It is used to report each employee's annual compensation and all federal, state, and other payroll tax withholdings. This does not need to be filled out for independent contractor workers; you'll fill out Form 1099 for them instead.

Due date: Jan. 31

5. Form W-3

The W-3 is a condensed version of your W-2 forms. For example, one W-3 can represent 10 W-2s. This form is called the Transmittal of Wage and Tax Statements. It includes total earnings, FICA wages, federal income wages, and tax amount withheld. You do not need to give W-3s to your employees. Your W-3 should be sent to federal and state governments along with your W-2 forms.

Due date: Jan. 31

6. Form 1095-B

If you provide a health insurance plan for your employees that meets or exceeds what the Affordable Care Act (ACA) calls "minimum essential coverage," file Form 1095-B. On it, you'll note the type of health insurance, whether dependents are covered, and the coverage period for the prior year. Your employees will use this form to prove they have qualifying health insurance that exempts them from paying a penalty when they file their tax returns. If your business has at least 50 full-time employees and is what the ACA calls an "applicable large employer," fill out Form 1095-C instead.

Due date: Jan. 31

7. Form 1094-B

Form 1094-B is the Transmittal of Health Coverage Information Returns, which is similar to the W-3 in that it summarizes Form 1095-B with the number of forms you're submitting. It also gives the IRS your name and phone number so it can contact you if it has questions about the forms. You don't have to send Form 1094-B to employees; submit it to the IRS along with the 1095-B forms. If your business is classified as an "applicable large employer," fill out Form 1094-C instead.

Due date: Feb. 28

8. Form I-9

Form I-9 must be included as part of your onboarding package for new hires. The form confirms employee eligibility within the United States. Both U.S. citizens and non-citizens complete Form I-9 before receiving payment for their work. The employee attests authorization to work in the United States while providing documentation (like a birth certificate or driver's license) to prove eligibility. Employers must review the documents and confirm that the papers appear genuine and are not falsified. The employer should keep Form I-9 on file in case of government review.

The Department of U.S. Citizenship and Immigration Services states that the form is required within three days of hiring a new employee. For example, if the employee starts work on a Tuesday, the form must be submitted to the employer by that Friday.

Due date: Three days after the hire date

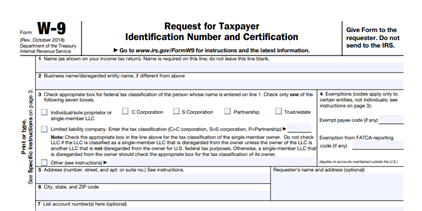

9. Form W-9

Form W-9 is specifically for companies that hire independent contractors. If the company pays the independent contractor more than $600 in a tax year, the company must report those payments to the IRS using Form 1099-MISC. On Form W-9, the employer asks the contractor (or freelancer) for the tax filer's name, address, and tax identification number. Since the W-9 is not filed, there isn't a specific due date for the form. However, companies should request the form be completed before paying the independent contractor.

Due date: At the time contract work is ordered

10. Form 1099-MISC

Use the 1099-MISC form when you make a payment of $600 or more to an individual or LLC. This includes attorney fees, awards, healthcare, royalties and rents.

Due date: March 1 if filed by paper, March 31 if filed electronically

11. Form 1099-NEC Beginning with the 2020 tax year, the 1099-NEC is a simplified way to report over $600 paid to a self-employed individual, freelancer, or contractor who supplied services to your business. The 1099-NEC covers fees, benefits, commissions, prizes, awards, etc., for non-employee-provided services.

Due date: Jan. 31 (distributed to recipients and filed with the IRS)

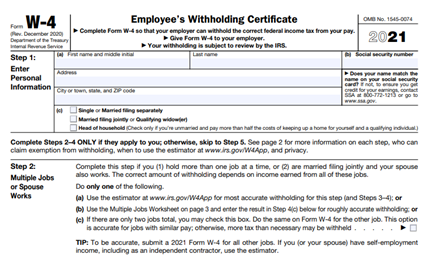

12. Form W-4

Provide a W-4 form to all new hires. Employees receiving the form should complete it before or on the first day of their new job. Form W-4 provides the employer with personalized tax withholding information that aids in maintaining an accurate payroll. Holding a W-4 for each employee streamlines the W-2 form preparation.

Due date: Feb. 15

13. Form 8027

Form 8027 is not a standard form. It only applies to companies employing more than 10 workers on a normal business day in industries where tipping is customary. Hospitality and food service companies are the most common industries that will use Form 8027. It reports any tip income an employee received while working directly for the business. If the tip amounts are too low for the size of the business, the company may be required to pay out allocated tips. Form 8027 calculates this formula for any amounts due.

Due date: March 1 if filed by paper, March 31 if filed electronically

What's a payroll direct deposit form?

A payroll direct deposit authorization form allows employers to send money to employees' bank accounts. Most employers ask employees to provide a voided check to fill out the form, as it provides the ABA routing number that identifies the employee's bank and account number. After the employee signs the form and gives it back to the employer, their money can be sent directly to their account.

Banks typically use the Automated Clearing House to coordinate these payments. This solution is not only greener and more secure than paper checks, it also cuts out the hassle of depositing a check or waiting for it in the mail.

What are certified payroll forms?

Businesses with government contracts need to submit a certified payroll form, also known as Form WH-347. When a payroll report is certified, it means employees have been paid according to the Davis-Bacon Act prevailing wage requirement. Certification includes a signed statement of approval that confirms the payroll forms are complete and correct.

A certified payroll report includes the names of every employee, the nature of the work they did, wages, hours worked, and amounts withheld. It's typically due on the last day of the payroll period.

When filing certified payroll forms, keep in mind that every state has its own requirements and may ask for multiple forms and filings. Be careful not to overlook your state's conditions.

How do you add an employee to payroll?

Adding an employee to payroll takes some prep work. Creating a payroll structure that works for your business and complying with federal and state labor laws streamlines the process of adding new employees.

Step 1: Obtain an EIN (employer identification number) from the IRS by submitting Form SS-4. You may also need to get state and local tax IDs.

Step 2: Verify that your new employee is eligible to work in the U.S. For you to do this, your employee must fill out the employment eligibility form, Form I-9, and an employee's withholding certificate, better known as a W-4, to make sure you withhold the correct tax amounts from each paycheck.

Step 3: Schedule pay periods and have compensation plans for holidays, vacations and other forms of leave.

Step 4: Once you have the completed forms from your employee, add them to your payroll. If you use a top payroll service, you'll need to contact the company to add your new employee to your plan. Always report your payroll taxes to the IRS on time to avoid penalties.

What's the difference between a payroll status change form and a payroll deduction form?

Payroll status change forms and deduction forms accomplish different things, but you need both when hiring employees.

Payroll status change form

As your business grows, you may have an employee whose status or position changes. This can affect their pay, whether they work full or part time, their position or job title, and the department in which they work. It's important to document these changes with a payroll status change form, which is then placed in the employee's personnel file as part of their employment history.

Payroll deduction forms

A payroll deduction form does just what its name suggests: It helps you determine and record how much money will be withheld from an employee's payroll check. Some deductions are mandatory, such as taxes, while other deductions are voluntary, like 401(k) plans, insurance plans, and union and uniform dues. Court-ordered payments, such as child support payments, may also be garnished from employee wages. This form gives your payroll provider the information it needs to withhold the proper amounts from your employees' paychecks.

Tips to avoid payroll mistakes

There's no shame in asking for help. If you're unsure how to set up payroll for your employees, or if you want to save yourself the trouble of navigating payroll regulations, sign up for a payroll service or hire an accountant. It's better to pay for the service and have it done correctly than to pay fines for your mistakes. Here are three tips to help you avoid common payroll mistakes:

- Pay attention to deadlines for tax payments and filing. Depending on your business, you may have payroll tax payments due annually or quarterly.

- Don't miscalculate overtime. Some states have their own overtime regulations, and in those cases, the regulation that will give the employee higher pay prevails. Check your state's labor laws beforehand to ensure you're paying your employees fairly.

- Set aside time for processing payroll. Late paydays lead to unhappy workers, and rushing can cause costly mistakes. If you overpay or underpay your workers, not only will you have to take time to make the correction, you may also face fines.

Julie Thompson contributed to the writing and research in this article.