Although small businesses are able to receive forgiveness on their Paycheck Protection Program (PPP) loans, only about half of borrowers have sought relief, even though loans of $150,000 or less only require a one-page application.

The reasons small businesses are delaying loan forgiveness vary. For some, rumors of impending wholesale forgiveness by the federal government are to blame. For others, it's procrastination. But with the first payment on many PPP loans coming due, small business owners need to act soon.

What is PPP loan forgiveness?

The Paycheck Protection Program was created at the height of the pandemic to help small businesses survive. Congress empowered the Small Business Administration to issue hundreds of billions of dollars in low-interest small business loans. Since then, nearly $800 billion has been released to 8.5 million small businesses. The PPP loans are forgivable as long as the borrower uses the money for qualified expenses, including keeping staff on their payroll. It also can be used for certain operating expenses and other business costs associated with the pandemic.

Borrowers are welcome to seek loan forgiveness as soon as the proceeds have been used. They can apply anytime up to the loan's maturity date, which is 10 months after the loan was issued. For example, businesses who took out PPP loans in January must start repaying in November if they haven't been approved for loan forgiveness.

"You have up until the loan matures if you are requesting forgiveness, but there is no incentive to wait," Alan Haut, the U.S. Small Business Administration's district director for North Dakota, told business.com. "You'll have to start making payments if you apply after the deferment period."

How do you apply for PPP loan forgiveness?

Depending on how much you borrowed, applying for PPP loan forgiveness can be a matter of minutes or may require more effort. Either way, here are the steps to follow:

Step 1: Contact your lender.

The first step in getting PPP loan forgiveness is to contact your lender directly. The lender has a responsibility to help borrowers get their loan forgiven. The SBA has streamlined the process by launching the PPP Direct Forgiveness Portal, which allows borrowers to automatically submit their forgiveness application to the lender.

There's a big caveat with this new tool. The lender has to sign up for the SBA's portal, which not all lenders have done. As of the end of September, 1,400 PPP lenders, or more than half, have opted in to the Direct Forgiveness Portal. That means about half of lenders have not opted in, so contacting your lender should always be the first step.

"You have to contact your lender and make sure they opted in," Haut said. "Many lenders have an online process of their own that is quick and easy. Starting with the lender is the best option."

If your lender is part of the Direct Forgiveness Portal and does not have an online portal of its own, use the SBA tool.

Step 2: Determine if you are eligible for loan forgiveness.

To get your PPP loan forgiven, you must meet specific requirements. The size of the loan will determine how much proof you need to provide. The eligibility requirements are as follows:

- At least 60% of the loan total was used to cover payroll costs and expenses.

- The remainder of the loan was spent on mortgage interest or rent, utility expenses, operating costs, property damage caused by the pandemic, supplies, and personal protective equipment (PPE).

- Employers attempted to maintain employment levels and pay that were in line with levels prior to the pandemic.

If you check off these boxes, you can move on to the next step.

Step 3: Determine which application is right for you.

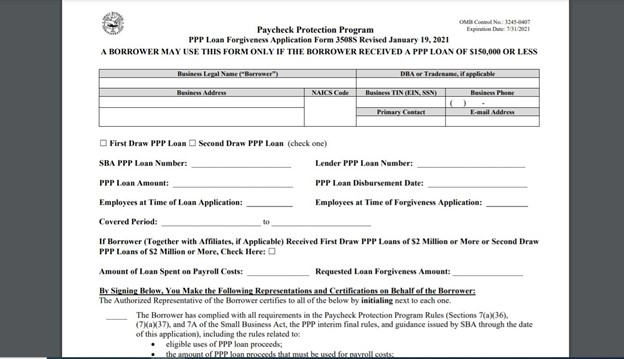

To receive forgiveness for your PPP loan, complete an SBA Form 3508. There are three versions of the application, based on the size of the loan and the number of employees on payroll. Each application requires basic business information, including name and address, tax ID number, and contact information. You'll need to indicate whether this is your First Draw or Second Draw PPP loan and input the loan amount and terms.

The main difference between the forms is the number of calculations you are required to perform.

SBA Form 3508EZ

Use Form 3508EZ if your business has no employees and can meet one of the following criteria:

- You are self-employed with no employees.

- You didn't reduce employee salaries by more than 25%.

- Employees' hours stayed the same.

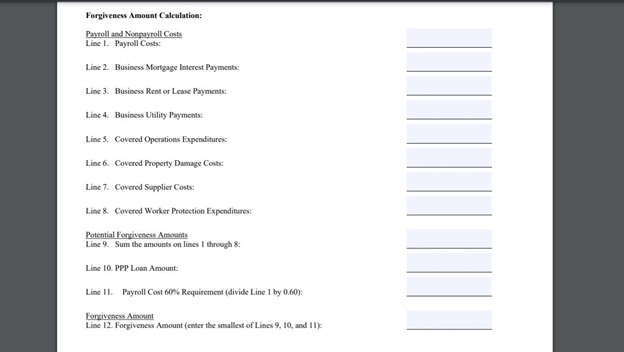

This three-page application includes the calculation form, signature form and an optional demographic information form. It requires you to list how the PPP loan was spent and to calculate your loan forgiveness amount.

SBA Form 3508S

Form 3508S is the most straightforward PPP loan forgiveness application to complete. It is only eligible for borrowers with loans of $150,000 or less. This two-page application requires no documentation and few calculations. When you use Form 3508S, no documentation is needed if it is your first PPP loan. For Second Draw PPP loans, borrowers have to prove that their revenue fell at least 25%.

SBA Form 3508

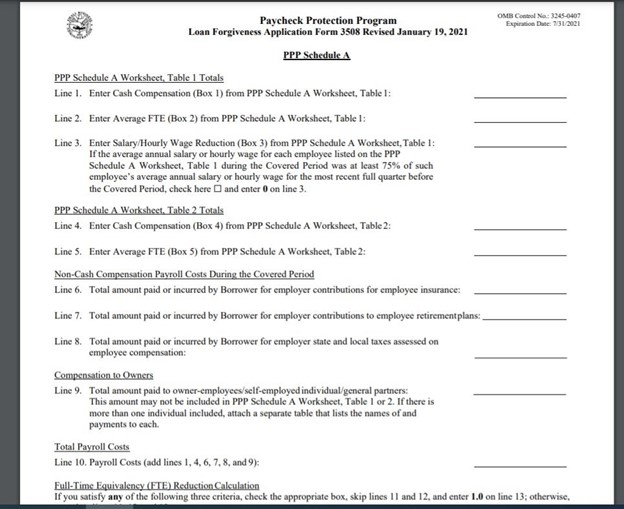

Form 3508 is the most complex of the three applications. It is for small business borrowers who aren't eligible to complete the 3508EZ or 3508S forms. The forgiveness application is five pages long and requires the most calculations. It includes a calculation page, signature form, Schedule A, Schedule A worksheet and the optional demographic information form.

Step 4: Don't wait too long to apply.

If you use the money from your PPP loan for its intended functions, you are guaranteed to receive loan forgiveness from your lender. But if you wait too long to apply, you could be forced to begin repaying the loan.

"Small business owners need to know they only have 10 months to procrastinate," said Brock Blake, CEO of online loan marketplace Lendio. "Once it's 10 months from when you got the loan, it is the day of reckoning. You have to start making payments after that."