At some point, you've probably heard the phrase, "It takes money to make money." But if you're not careful, it's easy to let your expenses spiral out of control and reach a point where you're making little to no profit.

That's why all businesses need to track their revenue and expenses with a profit and loss (P&L) statement. A P&L statement will help you measure your company's financial health and see how your business is trending.

Here's a look at what a P&L statement is, what it includes, and how you can use one to gain information about your business.

Editor's note: Looking for the right accounting software for your business? Fill out the below questionnaire to have our vendor partners contact you about your needs.

What is a profit and loss statement (P&L)?

A P&L statement is a financial report that summarizes a company's revenue, expenses, and profits or losses over a fiscal year or quarter. When you read a P&L statement, you'll see whether the company can generate sales, manage expenses and earn a profit.

The two main categories outlined in a P&L statement are income and expenses. Income includes things like product sales, interest earned, commissions or rental income. Expenses include the cost of goods sold, marketing and advertising fees, and taxes.

Why do businesses need to track P&L?

If you aren't a publicly traded company with shareholders to report to, you may wonder why it's necessary to create a P&L statement. But this financial statement gives you the following essential information about your business:

Profitability of your business

A P&L statement will indicate whether or not your business is profitable by showing whether you're losing money on the sale of your products or services. Tracking this information could help you come up with new ideas on how to increase sales.

Insight on how your business is performing

When you run a business, you want to look at more than your overall income. You also want to observe trends in your business and whether it's growing over time. Tracking industry trends can help you determine the specific actions you should be taking in your business.

For instance, if your gross revenue has been down since the beginning of the year, you need to focus on increasing sales. If your gross revenue is satisfactory, but the net income is down, look for ways to cut expenses.

The overall health of your business

At some point, you may need to apply for a small business loan. As part of the requirements for getting approved, your lender will ask for financial documents like a P&L statement. This document gives lenders a look at your business's overall health and shows them whether or not it's earning a profit.

Even if you never apply for financing, it's a good idea to generate a P&L statement at least once a year. The information you gather will help you make better business decisions. Fortunately, creating a P&L statement is easier than you might think.

What information do you need for a P&L?

A typical P&L statement will include four main sections: revenue, expenses, cost of goods sold and net income. Each section will make up a new line on the P&L statement.

Revenue

A company's revenue is its net sales during a given financial period. The revenue section will outline the revenue earned from its primary business activities. It will also show non-operating revenue and income earned from the sale of business assets.

Expenses

Your expenses are what you spend on the day-to-day operations of running your business. It includes things like business insurance, marketing costs and rent. These expenses are necessary to keep your business running, but don't directly help you produce more revenue.

Cost of goods sold

This section shows how much it costs your company to produce its products or services. For instance, if a business sells physical products, this section might include labor or materials. The cost of goods sold will not include overhead costs like rent payments.

Here is the formula you'll use to calculate the cost of goods sold:

Beginning Inventory + Purchases - Ending Inventory = Cost of Goods SoldYou may notice that while the cost of goods sold is technically an expense, it's not included in the expenses section. That's because businesses separate the cost of goods sold for tax purposes. The IRS says that businesses can deduct the cost of goods sold from their taxable earnings, which reduces their overall tax obligations.

Net income

Your net income is included at the bottom of a P&L statement. It's what's left after you subtract your expenses from your revenue.

If your net income shows that you earned a profit, your business is making more than it spends. If the company is spending more than it brings in, you have a net loss for that financial period.

What is included in a P&L statement?

Here is some of the information you should include in a P&L statement:

- Total revenue

- Total expenses

- Cost of goods sold

- Selling, general and administrative (SG&A) expenses

- Research and development expenses

- Marketing and advertising costs

- Interest paid

- Depreciation

- Earnings before interest, taxes, depreciation and amortization (EBITDA)

- Net income

A P&L statement includes a variety of information, but certain items won't be listed. For instance, you won't include your business's assets, liabilities or equity.

Example of a P&L

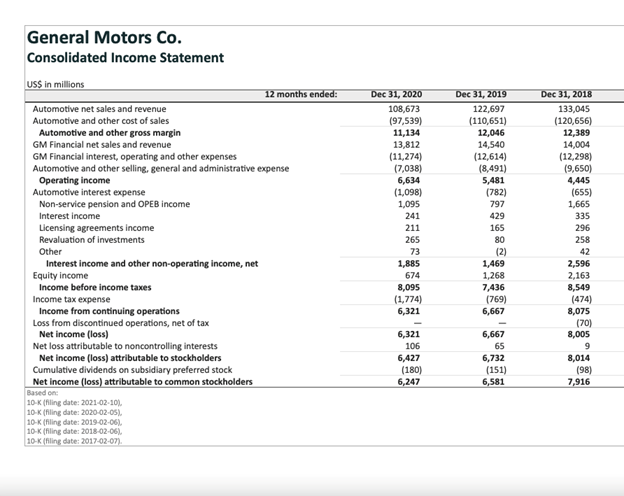

Below is a copy of General Motors' 2018-2020 P&L statement, which the company refers to as its Consolidated Income Statement. You'll notice that GM posted a net income of $6.4 billion in 2020, despite the pandemic.

How accounting software can help manage your P&L statement

Creating a P&L statement isn't difficult, and you could do it on your own. However, the process is much easier if you use accounting software, which will help you stay on top of your small business accounting challenges and help you avoid common accounting mistakes.

With the right accounting software, you'll already be tracking your revenue and expenses regularly. That means you can generate a P&L statement easily at the end of the quarter or year.

If you're trying to find the right accounting software, here are some of the best options.

QuickBooks

QuickBooks is our pick for the best accounting software for small businesses. Read our QuickBooks review for more information. The company provides a wide range of payment tiers, so its software can support you at every stage of your business. QuickBooks is a good option for everyone, whether you're a solopreneur or running an enterprise company.

QuickBooks provides many features, including the ability to generate financial reports like a P&L statement. It will automatically sort your transactions for you, and you can track your company's cash flow from your dashboard.

FreshBooks

FreshBooks is a cloud-based accounting and invoicing software you can access from any device. Read our FreshBooks review for more information. It's a good option for new business owners or individuals who aren't well-versed in accounting.

The software uses double-entry accounting, so you can easily create financial reports like a P&L statement and gain insight into your business's financial health. You can also invite your accountant to collaborate with you on your FreshBooks account.

Xero

We chose Xero as the best option for growing businesses because the software offers flexible features and a variety of pricing plans. Learn more in our review of Xero. It has all the features you need when you're just getting started, as well as advanced features like payroll and inventory management.

You can use Xero to track your expenses and understand your real-time cash position. You can also use the software to create financial reports and prepare for tax season.

Wave

Wave is free accounting software, and it's an excellent option for freelancers and small businesses. Read our Wave review for more information. The software is intuitive and comes with all the features you need to track your business finances.

Wave connects to your business checking account and will automatically track your income and expenses. You can use the dashboard to track outstanding invoices and see your cash balance. The software lets you create and export P&L statements with ease.

The bottom line

A P&L statement provides an overview of how much your business is earning and whether you're making or losing money. Companies of all sizes can benefit from creating and reviewing a P&L statement regularly.

If you're new to P&L statements, you can create one using a template, or you might want to consider investing in feature-rich accounting software.

Software like QuickBooks or Xero can help you track and manage your expenses and generate a P&L statement within seconds. That way, you can stay on top of your finances and be prepared come tax season.