Whether you run a brick-and-mortar shop or an e-commerce business, you need a point-of-sale (POS) system. A POS system provides the hardware and software necessary to accept customer payments and keep track of sales.

Shopify and Square are two highly rated POS systems for businesses. We researched these two POS systems extensively, looking at how they stack up in terms of pricing, hardware, customer support, and more.

Shopify vs. Square highlights

| Shopify | Square |

| Best for large retailers and e-commerce businesses, but can be used by businesses of all sizes | Best for smaller retailers and brick-and-mortar stores |

| Starting price of $9 per month | No monthly fees, and free magstripe reader for customers |

| Can use Shopify Payments or a third-party processor | Must use Square Payments |

| 24/7 phone support | Weekday phone support, 24/7 chat support |

Who is Shopify for?

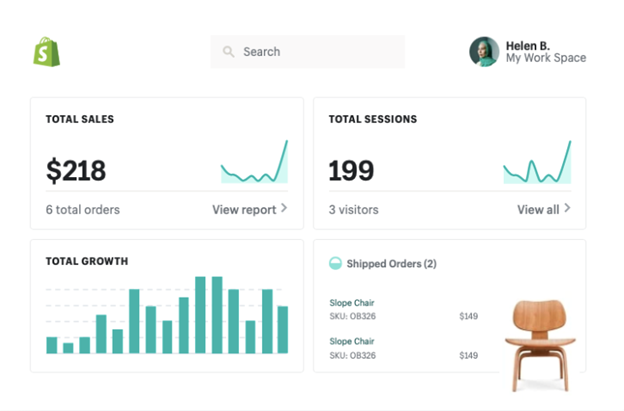

If you run an e-commerce business, you may already be familiar with Shopify. Shopify is an e-commerce platform that business owners can use to create an online store. You can also use the software to accept payments in person.

One great aspect of Shopify is that it's a good option for businesses of all sizes. The company can accommodate everything from beginners to experienced e-commerce businesses.

The main service the company offers is the ability to set up and customize an online store. The drag-and-drop store builder makes it easy for anyone to set up a professional website, and the dashboard will give you detailed analytics about your business.

You can use either Shopify Payments or a third-party processor to accept customer payments. But even if you don't have or want to set up a Shopify store, the company provides both the hardware and the software to accept payments online and in person.

Shopify is also an excellent option for businesses that provide a combination of online and in-store options. The company offers seamless checkout options, regardless of how customers complete their purchases.

If you want to get started with Shopify, let's look at the plans the company offers. Unlike Square, Shopify doesn't offer a free plan, but you can try the software for free for 14 days.

Shopify software plans

| Plan | Cost | Features | Best for |

| Shopify Lite | $9 per month | Overview dashboard, finance reports, customer profiles, order management, product management, mobile POS and hardware accessories, email carts, QR code product details, in-store inventory, gift cards, bill splitting, and custom discount codes | Companies that want to sell in person or add a buy button to their current website |

| Basic Shopify | $29 per month; plus 2.9% + $0.30 for online purchases, 2.7% for in-person purchases, and a 2% transaction fee for third-party processors | Online store, including an e-commerce website and blog, unlimited products, 2 staff accounts, 24/7 customer support, additional sales channels, up to 4 inventory locations, manual order creation, discount codes, free SSL certification, gift cards, and fraud analysis | New e-commerce businesses with occasional in-person sales |

| Shopify | $79 per month; plus 2.6% + $0.30 for online purchases, 2.5% for in-person purchases, and a 1% transaction fee for third-party processors | Everything in the Basic Shopify plan, plus up to 5 staff accounts, up to 5 inventory locations, shipping discount up to 88%, USPS Priority Mail Cubic pricing, international domains and international pricing | Growing businesses that sell online or in-store |

| Advanced Shopify | $299 per month; plus 2.4% + $0.30 for online purchases, 2.4% for in-person purchases, and a 0.5% transaction fee for third-party processors | Everything in all other plans, plus up to 15 staff accounts, up to 8 inventory locations, advanced reporting and third-party calculated shipping rates | Companies that are looking to scale and that need advanced reporting features |

Who is Square for?

Square is a payment processor that provides the hardware and software for POS systems and other small business services. Like Shopify, the company is a good option for businesses of all sizes. Unlike Shopify, which doesn't have a free plan, Square is also the best free option for a POS system on the market.

Square makes it easy for brick-and-mortar and online businesses to accept payments. The company charges a flat fee per transaction, and this fee remains constant no matter what type of card you are taking.

For many businesses, the real draw of Square is its POS hardware and software. You can use the POS app on iOS and Android devices, and it has an offline mode.

In addition, Square Online makes it easy to add online ordering functionality to your website. This service automatically syncs orders and inventory with your POS system as well.

Let's look at how much it costs to get started with Square.

Editor's note: Looking for the right POS system for your business? Fill out the below questionnaire to have our vendor partners contact you about your needs.

Square POS system

A Square POS system is free to use, with no startup costs. You simply download the app and won't be charged anything until you accept a customer payment.

All customers pay a processing fee of 2.6% plus 10 cents per transaction. This rate stays the same regardless of the type of card you accept.

If your company does more than $250,000 in credit card sales and has an average ticket price of over $15, Square will work with you to set up a custom pricing package.

Square hardware

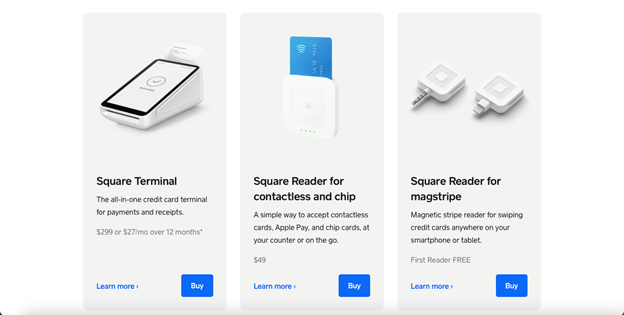

Square also offers hardware and equipment for in-store payment transactions. The company's magstripe reader is entirely free and can be used to accept credit card payments on a phone or tablet.

Here's some of the other hardware Square offers:

- Terminal: Square's all-in-one payment terminal costs $299, or 12 monthly payments of $27.

- Contactless and chip reader: This Square reader accepts chip cards and contactless payments and costs $49.

- Register: The POS register comes with two user-friendly displays, software options and built-in payments. It costs $799, or $39 per month over 24 months.

- Stand: With the Square stand, you can use your iPad as a POS system. The stand is $169, or $16 a month over 12 months.

Square and Stripe product/service criteria comparisons

Pricing

- Shopify: Shopify charges a monthly fee to use its services, and new customers can get started for as little as $9 per month. In addition, the company charges a 2.7% processing fee for credit card transactions. This fee gets lower as you invest in the higher-priced plans.

- Square: You can get started with Square for free, and there are no monthly charges. You'll pay a transaction fee of 2.6% plus 10 cents per card swipe, though larger companies may be able to get custom pricing.

Winner: Square wins when it comes to pricing, and it's the best option for new and growing businesses. You can download the app and get started for free, and you won't pay anything unless you make a sale.

Hardware

- Shopify: Shopify provides hardware like a Tap & Chip card reader for $49, a retail stand for $149, and a mini stand for $119.

- Square: Square provides a free magstripe reader, a contactless and chip reader for $49, and a stand for $169.

Winner: The two companies are pretty evenly matched when it comes to hardware. Both Square and Shopify provide high-quality, affordable hardware. But Square provides a free magstripe, which is ideal for brand-new entrepreneurs.

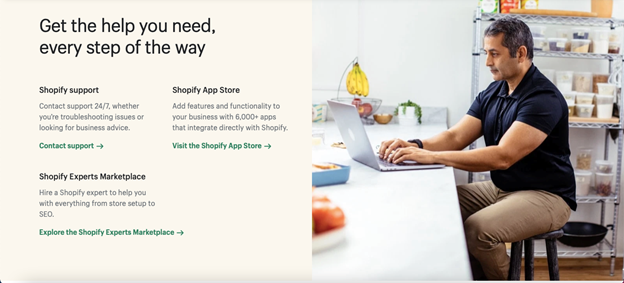

Customer support

- Shopify: Shopify provides 24/7 phone support for its customers, as well as video tutorials and webinars to help you get started. You also have access to the Shopify Community, where you can get your questions answered by other Shopify users.

- Square: Square provides 24/7 chat support, and phone support is available Monday through Friday. It also has video tutorials and a seller community where you can talk to other business owners.

Winner: Both companies provide strong customer support, but Shopify wins for its 24/7 phone support.

E-commerce

- Shopify: Shopify is one of the best options available for e-commerce businesses. The company offers excellent shopping cart software and easy setup for custom websites. You'll also receive a custom domain and hosting, order management, and third-party integrations.

- Square: Square also provides e-commerce integration and hosting. You can also use Square to manage and track your inventory and orders. Additionally, the reporting dashboard gives you insights into your business.

Winner: Shopify offers more e-commerce features than you'll get with Square.

Shopify vs. Square summary

Shopify and Square both provide solid options for brick-and-mortar and e-commerce businesses alike. It's hard to say which is the overall winner, since both solutions offer excellent customer support, are easy to use, and provide transparent pricing.

Ultimately, the best service for you will depend on the type of business you run. If you operate a brick-and-mortar store, Square may be the better option for you.

Square is also ideal for any business just getting started, thanks to its free magstripe reader and app. The processing fees are roughly the same between the two companies, but Square doesn't charge monthly fees.

However, Shopify is ideal for e-commerce businesses and anyone who needs to set up an online store. The drag-and-drop web builder makes it easy for beginners, and the service works well for businesses of all sizes.

FAQs

What's the difference between Shopify and Square?

Shopify and Square both offer POS systems for online and brick-and-mortar businesses. Square is free to use, while Shopify charges a monthly fee. Shopify is the better option for e-commerce businesses, while Square is best for brick-and-mortar businesses.

Is Square or Shopify cheaper?

It depends on whether you're asking about hardware or software. Some of Square's hardware is more expensive than what Shopify offers, but Square doesn't charge a monthly fee. Also, when you sign up with Square, you'll receive a free magstripe reader.

How much do Shopify and Square take per sale?

If you sign up for the Basic Shopify plan, you'll pay 2.9% plus 30 cents per transaction. The transaction fee gets cheaper if you upgrade your plan, but then you'll pay more in monthly fees.

With Square, you'll pay a transaction fee of 2.6% plus 10 cents per swipe. Custom pricing is available for businesses that process over $250,000 in credit card transactions.