When you’re shopping for a credit card processor, it’s easy to get overwhelmed with all the details.

Some sales reps throw numbers at you, while others talk about fancy features you’re not even sure you need, while processors' websites are no better, showing easily manipulated charts with big X’s for their competitors, giving themselves check marks in every category, and promising the moon.

Here’s a guide to the biggest red flags to watch for, illustrated with examples from the website of a fictitious company called Fuzzy Credit Card Processing, which was designed to highlight the types of warning signs this article will discuss. (Remember, Fuzzy is a fake company, but the examples you’ll see on the site are common in the processing world).

Related Article: The Truth About Free Credit Card Processing

They Quote a “Qualified” Rate

I’m listing this one first because it’s the biggest red flag if you’re looking for affordable credit card processing for your business. You’ll want to avoid any processor that uses “qualified” rates, which are an indication of a pricing model called bundled or tiered pricing, the most opaque form of pricing.

With tiered pricing, processors quote a very low rate; what they won’t tell you is that only some of your transactions will qualify for that rate, and they’ll charge you more for everything else. The rate that they quote you will be the “qualified” rate, and it will often have an asterisk or a footnote that says it only applies to qualified transactions.

But that’s not all. Another problem with “qualified” rates is that they can change at any time, for any reason. Processors don't always disclose the criteria for qualified transactions to you when you sign up, and even if they did, they can change it later if they feel like it.

What it looks like in action:

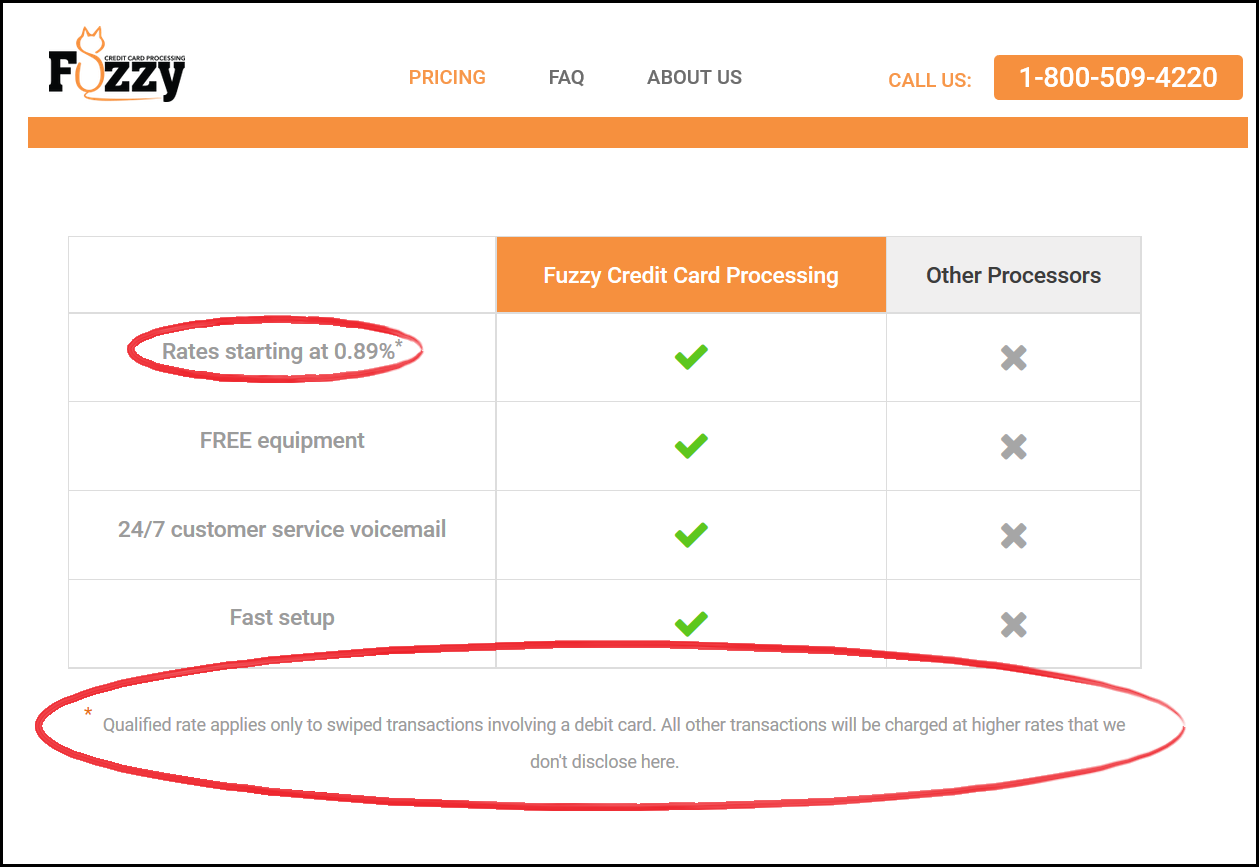

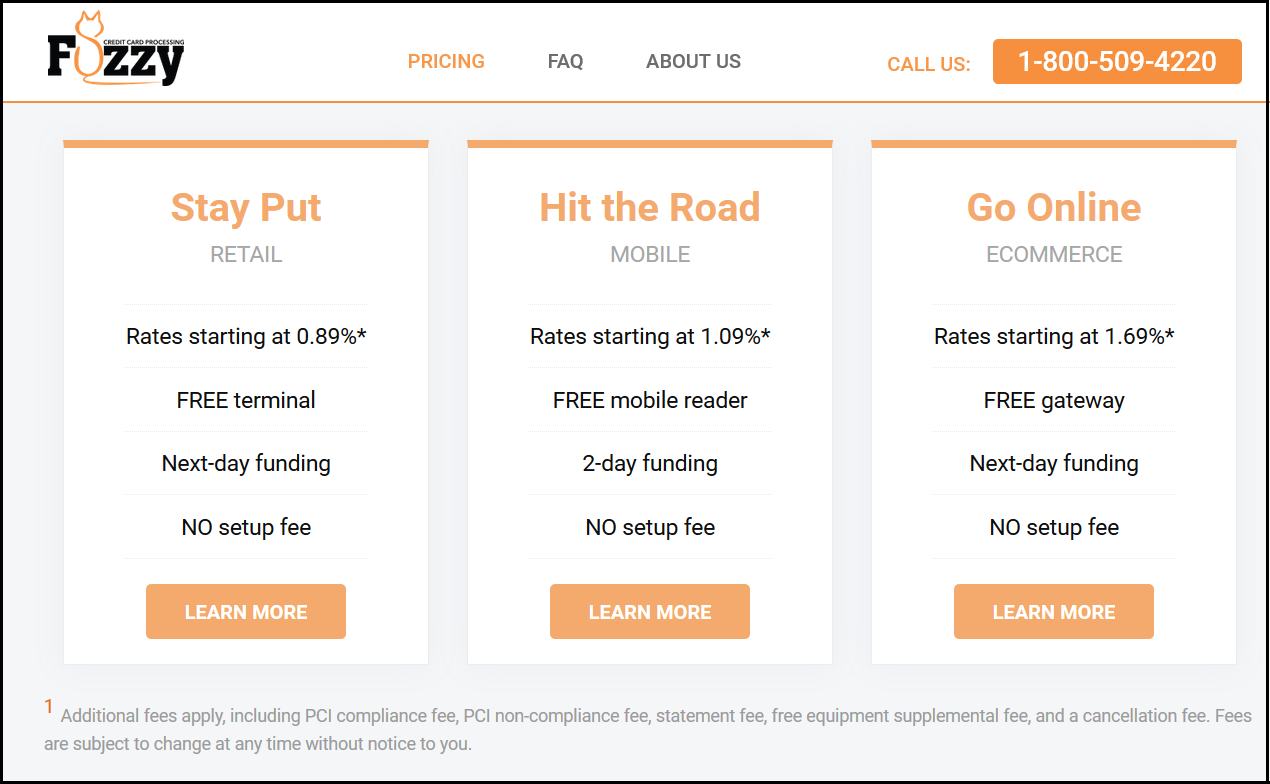

In this screenshot from fictitious company Fuzzy Credit Card Processing, the chart lists a very low rate, but the fine print tells a different story.

It says, “Qualified rate applies only to swiped transactions involving a debit card. All other transactions will be charged at higher rates that we don’t disclose here.”

In this example, the fake company mentions that the quoted rate only applies to swiped debit cards, but in some cases, you won’t even get that much information. Instead, the processor may just say, “Rates are for qualified transactions” and cover themselves by using the phrase “rates starting at” without clarifying what the additional rates are or when they apply.

Related Article: Seeing Green: 7 Payment Processing Solutions for Small Businesses

They’ll “Match” Your Rates

The second red flag is “matching” or beating your rates. This red flag often comes with a tempting offer, usually a guarantee of matching your current rates or paying you $500 (or some other amount of money) that makes you think, “Well, what’s the harm?”

The harm is when the processing company comes back with the good news that they can “beat” your rates. What they don’t mention is that all it means is that they can quote you a lower number for one part of the processing cost… but that you won’t necessarily see any savings. In fact, some businesses end up paying much more when they switch based on “low rates.”

You end up with more expensive processing, while the processing company gets out of it with a new account (yours) that they overcharge for, and they didn’t have to pay out the $500 because they “beat” your rates. Not exactly the kind of deal that’s to your advantage.

What it looks like in action:

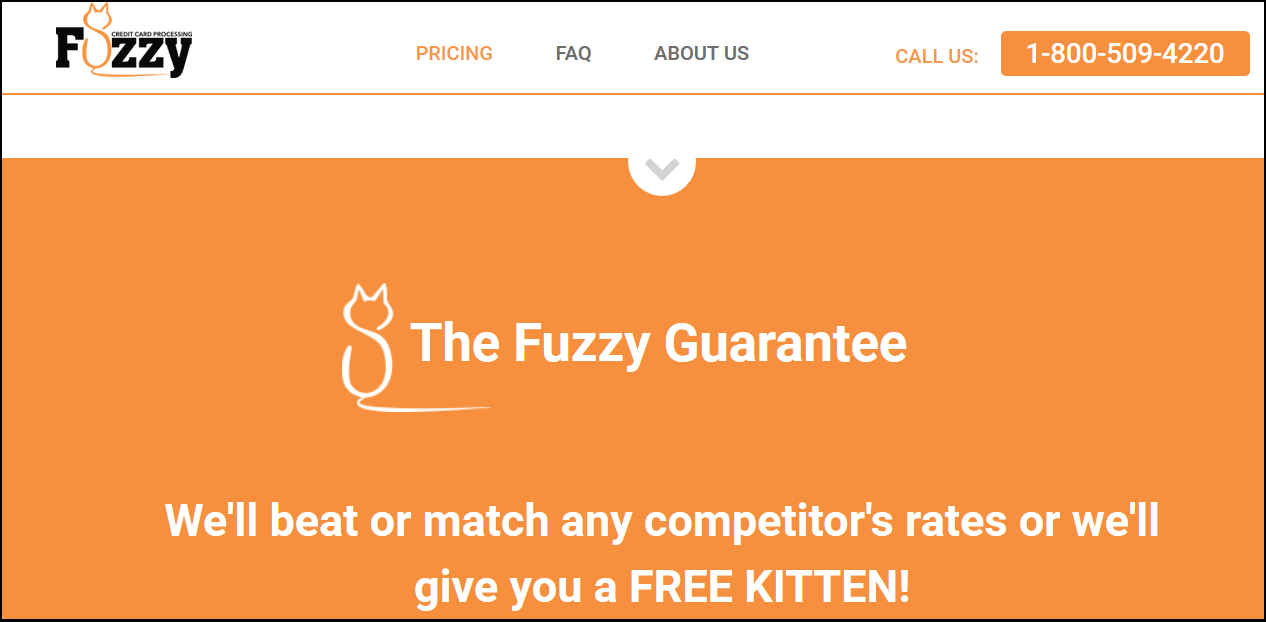

This one is usually the most obvious because the processor’s website will explicitly state that they’ll give you money if they can’t beat or match your current rates or the sales rep will make the offer.

The screenshot from the fake Fuzzy website highlights just how silly the practice has become in processing. They’ll match your rates or give you a free kitten? Well, of course, you’re never going to get a free kitten from a processor just like you won’t get the $500 they promise if they can’t beat or match your rates. They’ll always find a way to show that they can at least “match” your rates so that they never have to dole out the money.

They Suggest Leasing Equipment

Do not lease equipment. If there’s only one thing you take from this article, it’s don’t lease equipment. At CardFellow, business owners tell us about how they were locked into expensive, non-cancellable leases almost every day, often facing harassing phone calls and even lawsuits when they try to end their lease.

Leases usually go through a third party and include a separate contract from your credit card processing agreement. With some exceptions, lease contracts are usually 48 months and ironclad. Some leasing companies aggressively pursue small businesses that try to end their lease or close their bank account, so save yourself the trouble and don’t lease equipment.

Aside from the lawsuits and phone calls, it’s also just more expensive to lease a machine than it is to purchase one. Chip-capable credit card machines start around $300 for a basic model; not pocket change, but it’s much better than $50/month for four years. Over time, that machine that you could have purchased for $300 has cost you $2,400.

Processors may not have this particular red flag displayed prominently, so be sure to read documents that you sign, and ask about anything related to equipment.

They Offer “Free” Equipment

Offering “free” equipment is leasing’s less-dangerous little brother. You know the old saying: there’s no such thing as a free lunch. It applies here, as well. When a processing company offers you “free” equipment, they’re making up for it somewhere, usually in the form of higher rates and credit card transaction fees for merchants. Think of it this way: companies that offer you the most competitive pricing don’t have the margin to offer you a free machine as well. Keep that in mind when looking for the right processor. Is saving $300 upfront worth paying more per transaction every time you swipe a credit card?

What it looks like in action:

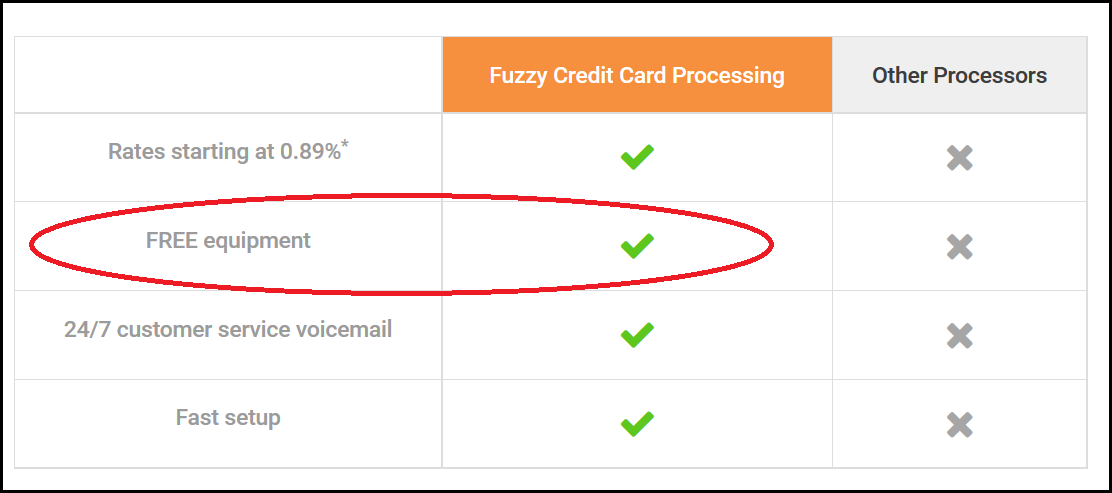

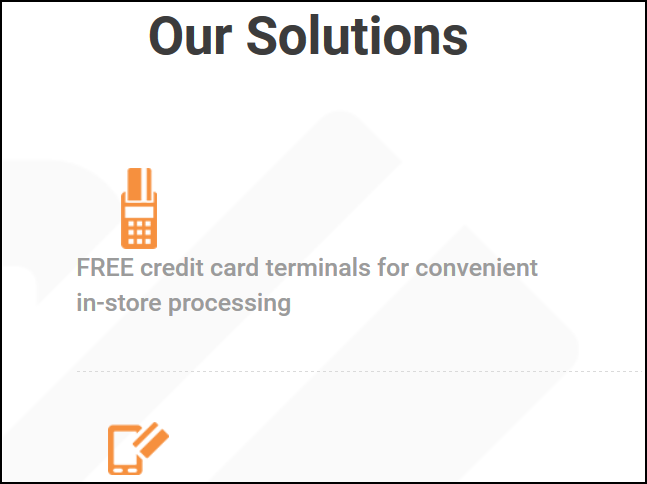

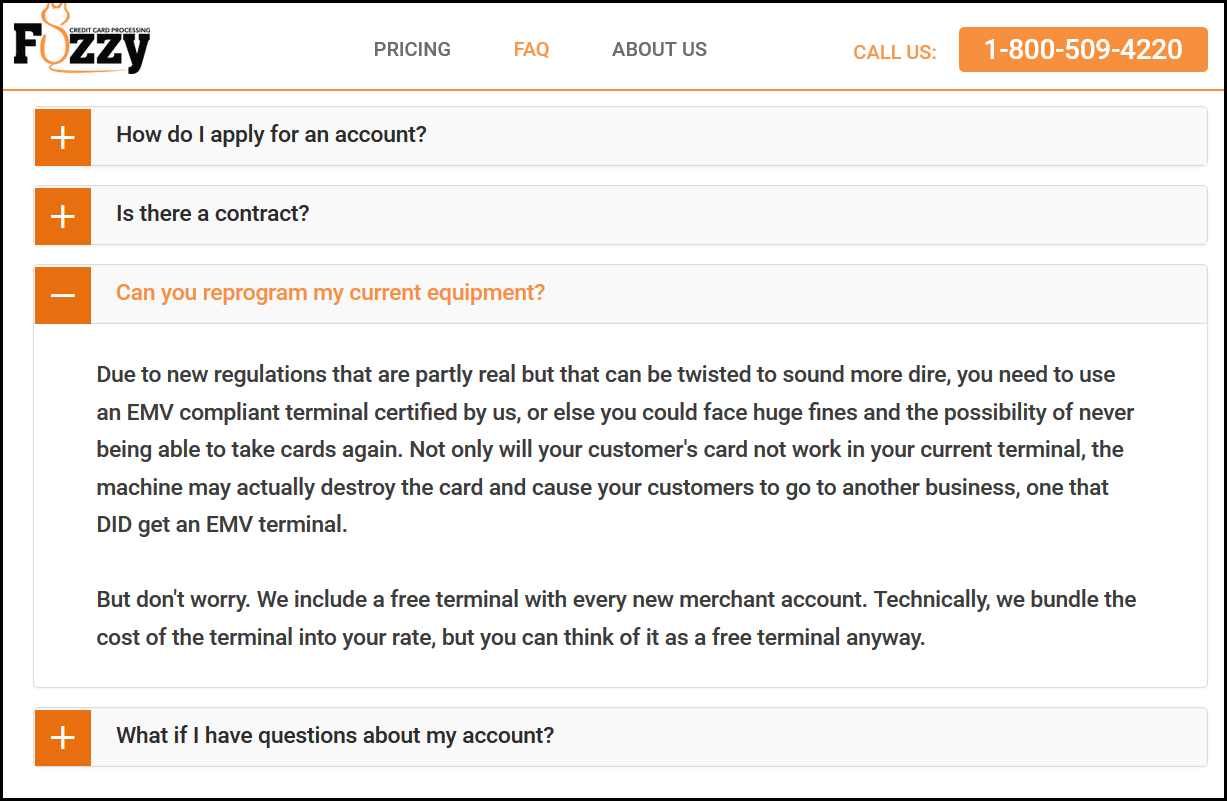

Free equipment is a big draw for many people, so a processing company is likely to mention it on its website multiple times, in multiple locations. In the fictitious example I’ve been using, it shows up in:

A comparison chart:

The “solutions” section:

The “pricing” section:

And a Frequently Asked Question:

There are many underhanded tactics in processing, but keep this list handy and avoid these warning signs and you’ll be on your way to finding an ethical, competitive processor.