Most freelancers and contractors are aware of the 1099-MISC form. The 1099-MISC is used to track income throughout the year that was not already taxed. In 2020, the IRS added a new form to the tax catalog, a 1099-NEC, short for "nonemployee compensation." In this article, we will outline what you need to know about the new form, the differences between a 1099-MISC and a 1099-NEC, and how to minimize tax mistakes for your small business.

What is a 1099-NEC form?

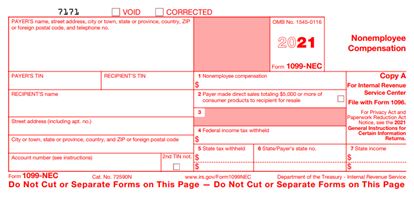

The 1099-NEC is a simplified way of reporting independent contractor wages. You can view the sample form here. However, you cannot download the document directly from the IRS website. Instead, the form must be ordered or filed online via the FIRE system.

The 1099-NEC should be used instead of the reporting independent contractor payments in box 7 of the 1099-MISC form.

Who gets a 1099-NEC form?

Self-employed individuals who supply services to a business that exceeded $600 may receive a 1099-NEC from the company that they provided services for. In addition, freelancers and contractors may receive a 1099-NEC, as they are not W-2 employees of the business.

If you provide services to an individual, you will not receive a 1099-NEC. However, you still need to report that income when you file your tax return.

What is reported on a 1099-NEC?

A 1099-NEC covers several types of income. The information you will fill out on this form includes:

- Fees

- Benefits

- Commissions

- Prizes and awards (nonemployee-provided services)

- Other forms of compensation (nonemployee-provided services)

What is a 1099-MISC form?

The 1099-MISC form is used if a $600 or more payment was paid to an individual or LLC. Rent, legal fees and prize winnings all qualify to be reported on a 1099-MISC.

Who gets a 1099-MISC form?

Payees who are eligible for the 1099-MISC form should complete a W-9 form. All payments, including attorneys' fees, awards, healthcare, royalties and rents, should be reported if totaling $600 or more.

What is reported on a 1099-MISC?

Here's a closer look at the items a 1099-NEC includes.

- Attorneys' fees: Box 10 includes payments to an attorney or law firm, including corporations. A 1099-NEC should be used for attorneys' fees, while a 1099-MISC should be utilized for lawsuit settlements, etc.

- Awards: Box 3 of the 1099-MISC is reserved for awards and prizes, including monetary and merchandise. The form will be issued for any winnings over $600 but does exclude gambling profits.

- Healthcare: Within box 6, report payments your company paid to healthcare providers, healthcare insurance companies, doctors, suppliers, etc. It is not necessary to report payments to pharmacies for prescription drugs.

- Royalties: Royalties must be reported in box 2 for any amount $10 and above during a calendar year. Royalties include copyrights, patents, oil, gas, etc.

- Rents: Rents should be added to the 1099-MISC form's box 1. Rents include payments regarding renting or leasing space for business use (not payments made to real estate agents or property managers). Rents also include machine rentals (any machine operator payments should be reported on a 1099-NEC), pasture rentals and coin-operated amusements.

Differences between 1099-MISC and 1099-NEC

As of 2020, the 1099-NEC form is for all independent contractor income. The 1099-MISC is still a valid form. However, it is reserved for payments that fall outside of contractor or freelancer wages, such as rent or attorneys' fees.

The due dates for the forms are different as well. For example, the 1099-NEC is due Jan. 31, whereas the due date for the 1099-MISC is March 1 if filed by paper and March 31 if filed electronically.

Example of 1099-NEC form

How to file a 1099-NEC

Form 1099-NEC has two copies: Copy A and Copy B. Copy A should be filed with the IRS, and Copy B should be sent directly to the contractor. Any contractor you hired and paid $600 or more for services rendered in a calendar year must report those earnings.

Contractors receiving Copy B of 1099-NEC are not required to file the said form. However, you should receive a copy of 1099-NEC and can request one from the employer if needed for your records. Report any self-employment income on Schedule C.

State requirements

Some locations also require you to file your 1099 with your state. The following states are exempt from 1099 filing:

- Alaska

- Florida

- Illinois

- Nevada

- New Hampshire

- New York

- South Dakota

- Tennessee

- Texas

- Washington

- Wyoming

Some states have additional rules about filing electronically regarding 1099. Always consult your CPA to make sure you are IRS compliant with your forms, including 1099.

How to fill out a 1099-NEC

Companies that need to file a 1099-NEC will first need a W-9 form from the contractor. A W-9 form includes the contractor's legal name or business name, business entity, current address, and taxpayer identification number. Use the W-9 information to fill out the 1099-NEC, double-check payment totals and note this on the form.

Where to send the 1099-NEC

Since the 1099-NEC cannot be downloaded from the IRS website, you will need to plan to make sure you file on time.

Copy A

Send Copy A to the IRS by Jan. 31. You can either mail the form or file it electronically.

To receive a paper copy of the 1099-NEC, request one through the IRS website. If you are mailing the 1099-NEC, you will need Form 1096 as a cover sheet. Fill out both forms and then mail them to the IRS.

Filing electronically also requires some prep work. To use IRS's FIRE System (Filing Information Returns Electronically), you must use compatible software that converts IRS forms into the proper format. No scanning of documents is accepted.

Before you work with FIRE, you will need a Transmitter Control Code. To get a TCC, fill out Form 4419 and submit it to the IRS at least 30 days before the 1099-NEC tax deadline. Early submittal of Form 4419 will allow the IRS enough time to provide you with your TCC. Once you receive your TCC, create your account with FIRE.

Copy B

Copy B can be physically or electronically sent to the individual contractor. However, you must have consent from the contractor to send the form electronically. Obtain consent by emailing the freelancer. If permission is not received, you will need to mail the 1099-NEC to the address you have on file from the W-9.

To follow IRS rules when gathering consent, include the following information for the freelancer:

- Notice that if the contractor does not supply consent for an electronic copy, they will automatically receive a paper copy

- How to withdraw consent (can be completed at any time via email or paper)

- Whether you are ask for consent for the current tax year or for as long as they work for you

- The hardware and software needed to view the form (if being sent electronically)

- Instructions on receiving a paper copy (even if they have already received an electronic one)

- Conditions on when the form will not be sent (for example, when the contract is mutually canceled or the contractor makes less than $600 in the calendar year)

- How to update their information to receive the form successfully

- Conditions on when the electronic form will no longer be available (for example, if the stored form is on a company server for a fixed duration of time)

When to send the 1099-NEC

Copy A (IRS) and Copy B (contractor) of the 1099-NEC form will be received by Jan. 31 of the following year. If Jan. 31 does not fall on a business day, forms will be received on the next business day.

Benefits of payroll software

Finding the right payroll software for your business can help prevent pain points by automatically staying on top of changing tax laws and streamlining tedious processes. It can also help you keep employee, contractor and vendor data all in one place; provide a variety of payment options to employees; give you access to payroll experts; and offer tax penalty forgiveness.

Gusto

Our review of Gusto found the cloud-based all-in-one software able to handle payroll processing, tax requirements and human resources. In addition, the software offers a combo package for businesses that need to automate more than one area of accounting and an a la carte approach that meets the needs of small businesses. Other features include health insurance administration, paid time off management, time tracking, employee onboarding and access to HR professionals.

Paychex

From small business to enterprise, read our Paychex review to see if they have a service plan for you. From payroll processing to tax obligations, Paychex offers custom payment options for your W-2 employees as well as seamless solutions for contractors and freelancers. Larger businesses can benefit from HR services, onboarding, employee background checks, benefits, compliance and more. Plus, you can pay your employees with direct deposit, paper checks or prepaid debit cards.

OnPay

Our OnPay review found that the software integrates with QuickBooks, Xero and more. The company claims it can save business owners over 15 hours a month with its mobile-friendly system that is easy to learn. In addition, OnPay helps you automate payroll and taxes, helps you streamline HR and employee self-onboarding, and gives you top benefit options by state.